Table of Contents

How to Invest in Stock Market: 15 Proven Steps for Beginners

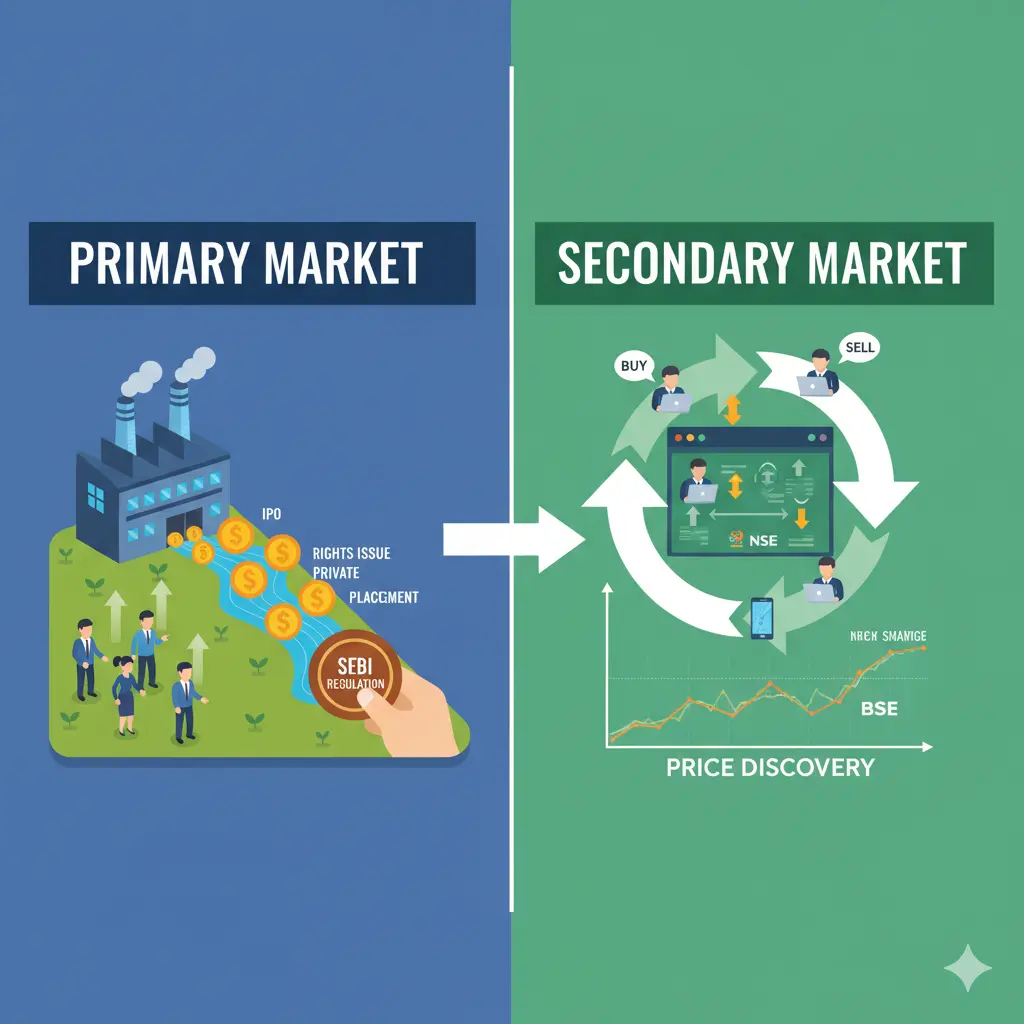

1). Primary market vs. Secondary market

The Primary market is where securities are created and issued for the first time. Companies raise capital directly from investors through instruments like original Public Immolations (IPOs), rights issues, or private placements. Here, the money paid by investors goes straight to the issuing company, helping it fund growth, expansion, or debt repayment. Pricing is generally fixed or decided through book building, and regulatory bodies like SEBI ensure transparency and investor protection. Understanding the functioning of the primary market is an essential step for anyone learning how to invest in stock market, as it helps identify opportunities to participate in new company offerings from the very beginning.

The Secondary market, on the other hand, is where these issued securities are traded among investors. Popular platforms include stock exchanges such as NSE and BSE. In this market, the company does not receive funds directly; instead, investors buy and sell to each other, creating liquidity and continuous price discovery based on demand and supply.

Financial Prerequisites – What You Must Do Before Investing

Build an Emergency Fund for investing and trading

Before you start investing and trading, make sure you have an emergency fund, for emergency time .

- Save at least 6 months of living expenses in an emergency fund.

- And Keep this money in the savings account or fixed deposit (not in risky assets

Clear And High-Interest Debt

- Credit card bills

- Your Personal loans

- And Buy Now Pay Later (BNPL)

Investing and Trading while having high-interest debt can hurt your financial growth.

Decide Your Monthly Investment Amount

- Fix a monthly amount For SIP And DCA

- Stay consistent and avoid emotional decisions And Clear Mindset

2). SEBI rules and Investor protection

The Securities and Exchange Board of India (SEBI) plays a vital role in regulating and safeguarding the Indian capital markets. Established in 1992, SEBI ensures transparency, fair practices, and investor confidence by creating strict guidelines for companies, brokers, and market intermediaries.

To protect investors, SEBI mandates detailed disclosures in prospectuses and annual reports, ensuring that investors receive accurate information before making decisions. It enforces rules against insider trading, fraudulent practices, and price manipulation, thereby maintaining market integrity.

SEBI also oversees the functioning of stock exchanges, mutual funds, and credit rating agencies. Through grievance redressal mechanisms like SCORES (SEBI Complaints Redress System), investors can file complaints directly against market participants. Investor education initiatives further help in spreading financial awareness.

By combining regulation, monitoring, and enforcement, SEBI provides a safe and transparent environment, where investors’ interests are prioritized and capital markets function smoothly. Understanding SEBI’s role is crucial for anyone exploring how to invest in stock market, as it ensures that every transaction takes place in a fair and well-regulated ecosystem.

Risk Management – How to Protect Your Capital

What Is a Stop-Loss?

A stop-loss limits of your losses if the market moves against your target.

Example in Sensex: Buy price = 100 & Stop-loss = 90

Dollar cost Averaging – (DCA)

Invest The fixed amount regularly with consistency

Works well in the volatile markets

Investing Psychology

Avoid the panic selling

Do not invest in greed, fear and Revenge

3). Keeping up with market trends

In the fast-paced world of investing, keeping up with market trends is essential for making informed decisions and minimizing risks. Market trends reflect the general direction of stock prices, sectors, or the economy over a period of time. Staying updated helps investors identify opportunities, adjust strategies, and avoid potential pitfalls.

Investors can track trends through financial news, stock exchange updates, research reports, and expert analysis. Tools like technical charts, market indices, and economic indicators provide valuable insights into short-term and long-term movements. Following corporate announcements, government policies, and global events is equally important, as they directly influence markets. Gaining an understanding of these factors is essential for anyone learning how to invest in stock market, as it helps in making informed and timely investment decisions.

With the rise of digital platforms, mobile apps, and AI-driven analytics, investors now have real-time access to data and forecasts. Ultimately, being proactive and consistent in monitoring market trends enables investors to stay ahead, make strategic choices, and achieve better returns in a dynamic financial landscape.

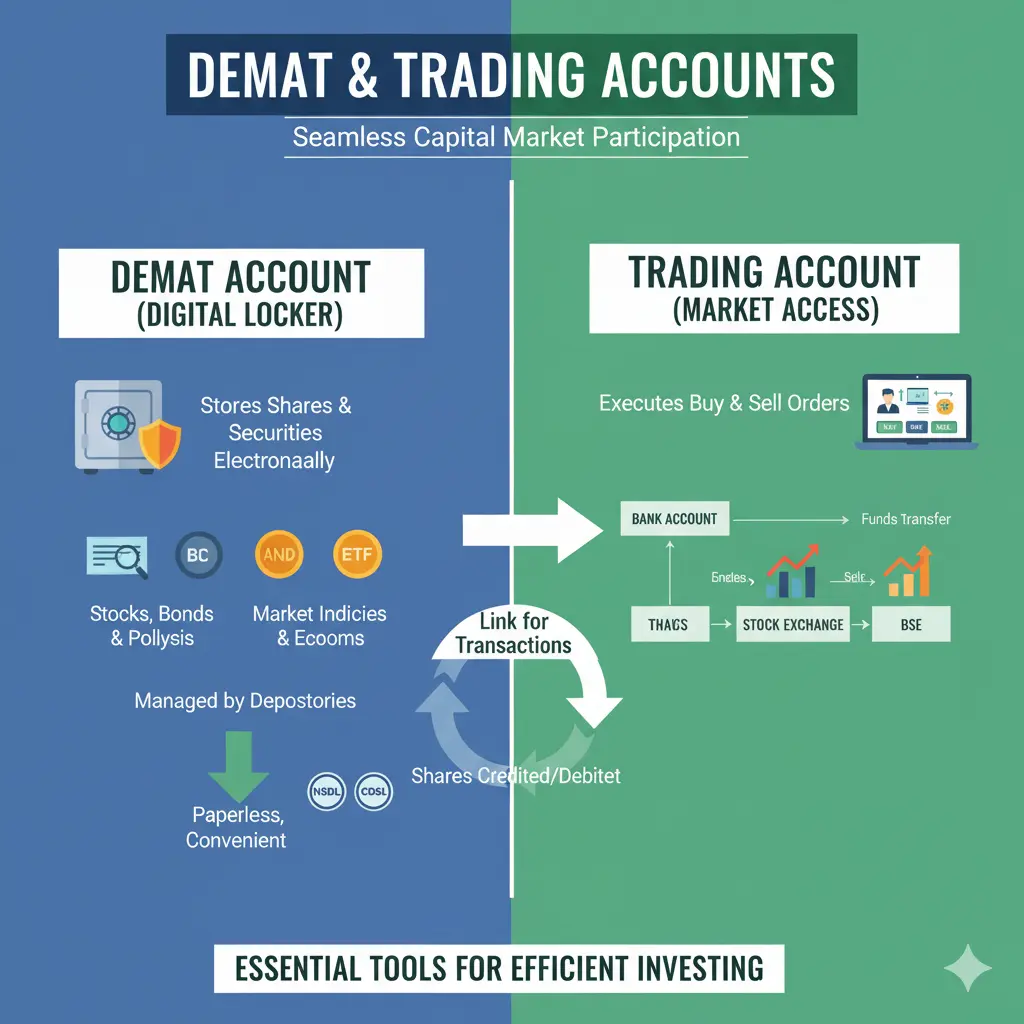

4). Demat account and Trading account

A Demat account (Dematerialized Account) is used to store shares and securities in electronic form. Instead of holding physical share certificates, investors keep them digitally, making the process secure, paperless, and convenient. It acts like a digital locker, holding assets such as stocks, bonds, mutual funds, and ETFs. Managed by depositories like NSDL and CDSL, a Demat account ensures safety, easy transfer, and reduced risk of loss or forgery. Understanding how a Demat account works is a fundamental step for beginners learning how to invest in stock market, as it serves as the foundation for trading and holding investments electronically.

A Trading account, on the other hand, is required to buy or sell these securities in the stock market. It serves as a link between the Demat account and the investor’s bank account. When an investor places an order, the trading account executes the transaction on the exchange, and the shares are then credited or debited from the Demat account. Together, Demat and Trading accounts are essential tools, enabling smooth, transparent, and efficient participation in the capital markets.

Stock Research & Fundamental Analysis (Basics)

How to Evaluate a Stock – Quick Guide

1. P/E Ratio- (Price-to-Earnings)

Helps to determine whether a stock is overvalued or undervalued

2. EPS- (Earnings Per Share)

He is Shows company profitability

3. Debt-to-Equity Ratio

Indicates how much debt in company has

Simple Example: Low debt & consistent profits usually indicate a healthy company.

5). Long-Term Investing vs. Short-Term Trading

Long-term investing and short-term trading are parts of the stock market. There are two ways to put in money in the stock market — the two main approaches known as long-term investing and short-term trading. Both aim to earn profits, but their time frames and strategies differ. Understanding these approaches is essential for anyone learning how to invest in stock market, as it helps in choosing the right method based on financial goals, risk tolerance, and investment horizon.

Long-Term Investing is a way to participate in the stock market in which investors hold stocks in mutual funds and ETFS for years. then make benefit from the company growth and also compounding and dividends. This mode is stable and also risk is low because this is a long run market and volatility gets balanced out.

Short-Term Trading investors makes profits quickly some time like over a few days , weeks, or months profits can earn easily but the risk is also high.

This is dependent on price movements timing and technical analysis.who was unlike long term investing so choose short term trading for quickly making profits.

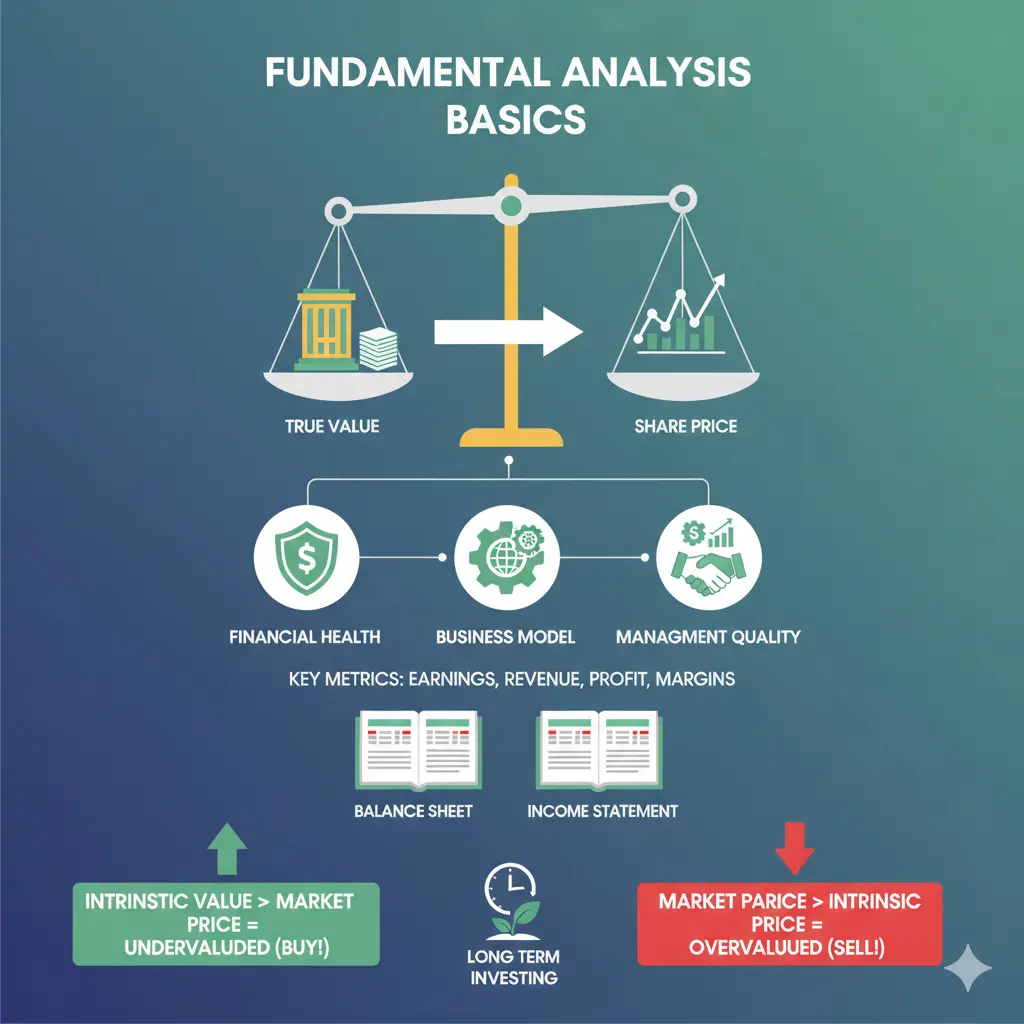

6). Fundamental Analysis Basics

fundamental analysis is a method in which we can understand the true value of a company and its not focus on the current share prices but studying the company financial health , business model and the management quality of the company and also future growth potential. The analysis of the company’s financial statements such as their balance sheet and income statement with the earnings , revenue , profit and margins. Fundamental analysis is an important thing for long term investing because this shows the company strength and also shows the company growth.

The main thing is, if the intrinsic value of a company is higher than its current market price, then the stock is known as undervalued — it is a good time to purchase it. On the other hand, if the market price is higher than the intrinsic value, the stock is known as overvalued. Instead of tracking daily stock price movements, understanding intrinsic value helps investors make smarter decisions and is an important concept for anyone learning how to invest in stock market effectively.

7). Technical Analysis Basics

Technical analysis is a method used to predict the future price movements of a company or its financial assets. It relies on various tools like candlestick charts, moving averages, RSI (Relative Strength Index), MACD, and support and resistance levels. These indicators help identify whether a stock is overbought or oversold and determine the right time for buying or selling.

Technical analysis is most useful for short-term trading, helping traders find correct entry and exit points. Everything is hidden in the price — by observing past price trends and market behavior, one can estimate future directions. Learning technical analysis is an essential part of understanding how to invest in stock market wisely and make data-driven trading decisions.

8). Value Investing vs. Growth Investing

stock market famous strategies are known for the investing is Value Investing and Growth Investing this is best investing ways and they focused in different things .Value investing the concept for to invest in those company there stock is undervalued that is there real price worth (intrinsic value) is little bit higher their current price value investors searching for such companies who have financial storage but are temporarily overlooked by this market this method is considered to carry the lowest risk and and provide steady returns.They are forced in value investing safety and undervaluation.

Growth Investing Growth investing in this investor focus on whose company who earning and revenue are growing fast and this company are frequently in a new technologies and innovations, or emerging sectors and the other thing is their stocks is commonly expensive and growth investors are expecting the future profits will be generated higher Growth investing there focus in future potential and fast higher returns and they grow faster.

Growth Investing in this investors focus on companies whose earnings and revenues are growing rapidly. These companies are often involved in new technologies, innovations, or emerging sectors. Their stocks are usually more expensive, but growth investors expect higher future profits. Growth investing emphasizes future potential and aims for faster, higher returns. Understanding this strategy is important for anyone learning how to invest in stock market, as it helps identify companies with strong long-term growth opportunities.

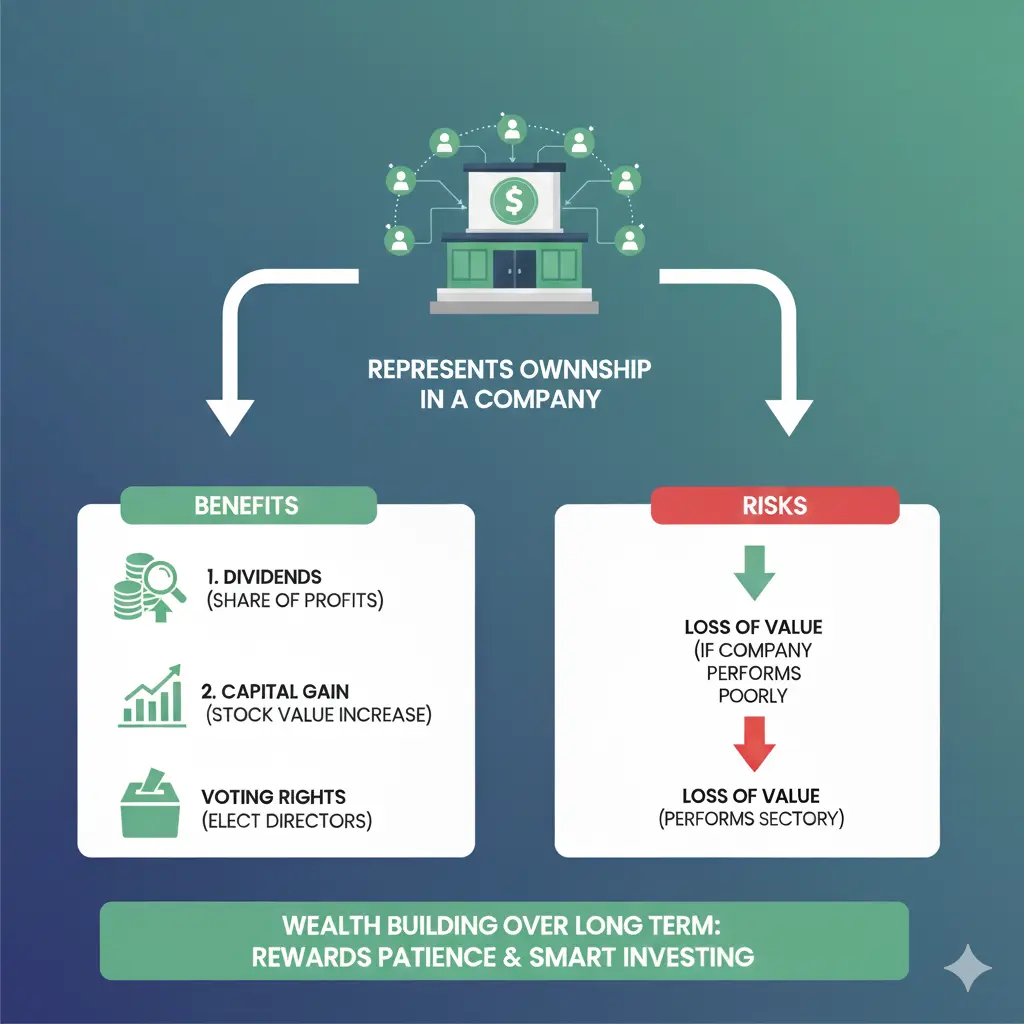

9). Common stocks

Common stocks represent ownership in a company. When you buy common stocks, you actually become a part-owner of that business. This gives you two main benefits: first, you can earn money through dividends (a share of the company’s profits), and second, if the company grows, the value of your stock can increase, giving you a capital gain. Understanding how common stocks work is essential for anyone learning how to invest in stock market, as they form the foundation of most investment portfolios and offer opportunities for both income and long-term growth.

As a common stockholder, you also get voting rights in important company decisions, like choosing the board of directors. However, there’s a risk too. If the company doesn’t perform well, the stock price can drop, and you may lose money. Even with these risks, common stocks are considered one of the best ways to build wealth over the long term. They reward patience, smart investing, in good companies.

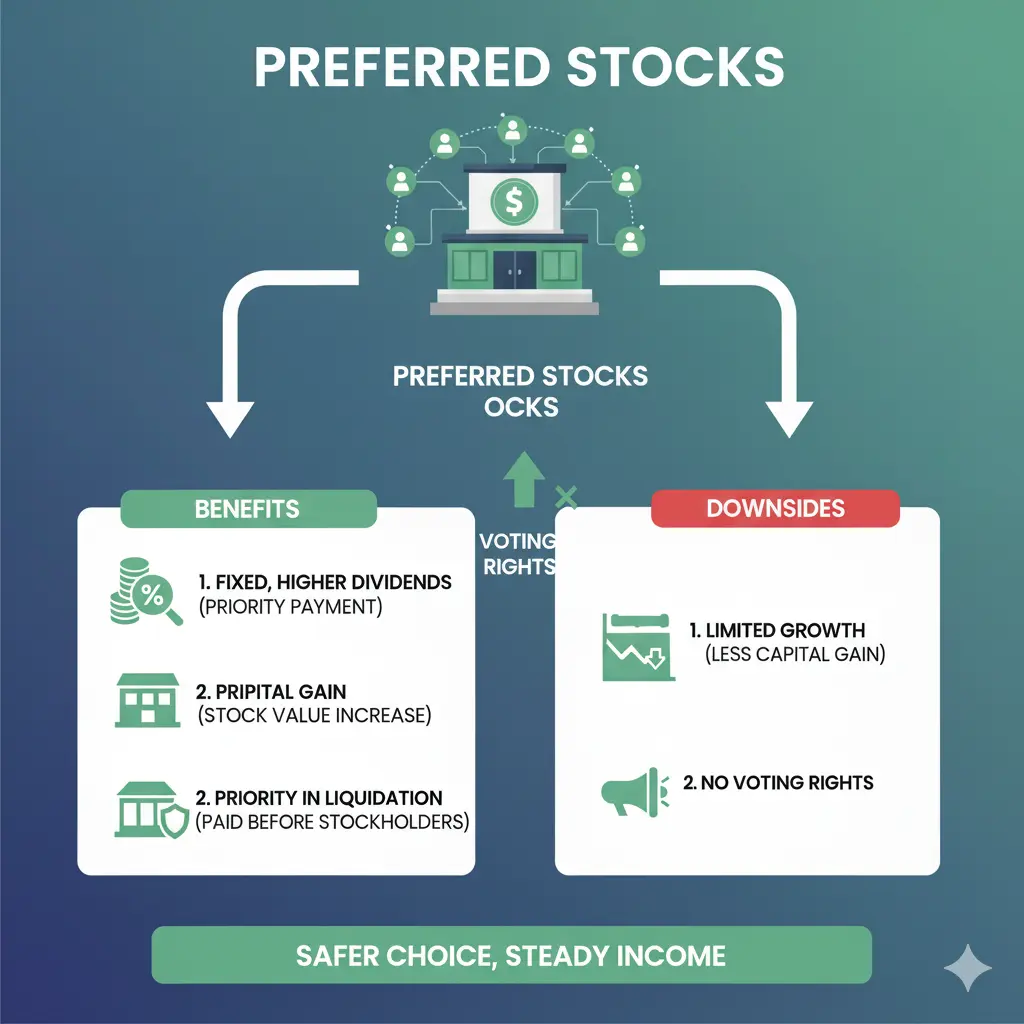

10).Preferred stocks

Preferred stocks are a type of investment in a company, similar to common stocks, but with some key differences. People who own preferred stocks usually receive fixed dividends, which are regular payments often higher than what common stockholders get. These dividends are generally paid before common stockholders receive any money. Understanding the role of preferred stocks is important for anyone learning how to invest in stock market, as they offer a balance between stable income and moderate risk, making them a useful option for diversified investing.

Unlike common stocks, preferred stocks usually don’t give voting rights, so owners have little say in company decisions. However, if the company faces financial trouble or bankruptcy, preferred stockholders have priority over common stockholders when it comes to getting paid.

Preferred stocks are often seen as a safer choice than common stocks because of the steady income and higher claim in case of liquidation. On the downside, they generally have less potential for big profits, since their value doesn’t grow as much if the company becomes very successful. Knowing the advantages and limitations of preferred stocks is essential for anyone learning how to invest in stock market, as it helps in making informed choices between stability and growth potential.

11).Swing trading

Swing trading is when a trader buys and sells stocks, crypto, or other assets over a few days to a few weeks to make profits from short- to medium-term price movements. Unlike day trading, you don’t have to watch the market all day—you hold your positions longer to catch “swings” in the market. Traders use charts, patterns, and market news to decide the best time to enter or exit a trade. Swing trading can be less stressful than day trading but still requires focus, patience, and smart strategy.

The idea is simple: buy when the price is likely to rise, sell when it peaks, and repeat—making steady gains over time. Learning swing trading techniques is a practical step for anyone exploring how to invest in stock market, as it provides a method to profit from short- and medium-term market movements.

12). Risks of investing in the stock market

There is a lot of risk in the share market because sometimes prices go up and down, which means when we invest money we can face a loss or sometimes make a profit. The company we invest in might also perform poorly or fail; if the company doesn’t accept the shares at the price we offer and finds the price too low, we might face a loss.

Similarly, when a person, company, or government borrows money in the form of a loan, there is a risk that they may not repay the money or interest on time — this is called credit risk. Understanding these risks is crucial for anyone learning how to invest in stock market, as it helps make informed decisions and manage potential losses effectively.

13).Rewards of investing in the stock market

By investing in the share market, our money can grow over time. When a company’s value and profit increase, the price of its shares automatically goes up. By investing in the share market, one can build good wealth for the future. Shares can be easily sold when needed. Learning the basics of how to invest in stock market is essential to make informed investment choices and maximize potential returns over time.

14).Different ways to invest in the stock market

1- Direct stock investment :- In this you can directly buy shares of any company for this a demat account and a trading account are required profit is earned when the share price increases or when the company gives dividends.

2- Mutual funds :- In this the money is invested in multiple companies by a fund managerYou can also invest a small amount every month through SIP.

3- Initial Public Offering When a company sells its shares in the stock market for the first time, it is called an IPO.

4- Index funds :- This is also a type of mutual fund, but it specifically follows an index (like Nifty or Sensex). It has low fees and provides stable returns in the long term.

15). High growth potential

When a business is growing rapidly and its demand in the market is increasing, it is said to have high growth potential. For example, when Zomato started, it was seen as having high growth potential because the trend of online food delivery was growing rapidly. Companies with rapid growth in sales, profits, and expansion can be beneficial to invest in, as they have high growth potential. Understanding how to identify such companies is important for anyone learning how to invest in stock market, as it helps in selecting stocks with strong future growth prospects

conclusion

The stock market serves as a robust platform for wealth accumulation and the attainment of financial independence; however, achieving success is contingent upon awareness, discipline, and strategic planning. Just as understanding the difference between AI and Machine Learning is crucial in the tech world, a comprehensive understanding of both primary and secondary markets, adherence to SEBI regulations, and the utilization of instruments such as Demat and Trading accounts establish a solid groundwork for secure investing. Learning these fundamentals is essential for anyone exploring how to invest in stock market, as it provides the knowledge and tools needed to make informed and profitable investment decisions.

By acquiring knowledge in fundamental and technical analysis, investors are better equipped to make informed decisions and reduce risks.

Staying abreast of market trends, selecting the appropriate strategy between long-term investing and short-term trading, and considering options such as mutual funds, IPOs, or index funds contribute to diversification and the enhancement of returns. Platforms and insights from trusted agencies like Shark Mondo can further guide investors in making informed choices. Ultimately, ongoing education, patience, and well-informed decisions empower investors to capitalize on high-growth opportunities and achieve enduring financial stability. Understanding these strategies is vital for anyone learning how to invest in stock market, as it helps in making smarter, goal-oriented investment decisions.