Table of Contents

How to Buy Cryptocurrency in India

Introduction

In the past few years, cryptocurrency has become a popular investment option in India. From Bitcoin to Ethereum, and thousands of other coins, digital currencies are attracting young investors, traders, and businesses. Many see it as a new way to build wealth and join the global financial system, and topics like How to Buy Cryptocurrency in India are gaining massive interest among beginners.

But the big question many beginners ask is, “How to Buy Cryptocurrency in India and how do I actually buy cryptocurrency in India?” If you’re confused, don’t worry. In this guide, I’ll explain everything step by step in simple terms, covering legality, exchanges, payments, wallets, risks, and safety tips. By the end, you’ll have a clear idea of how to start your crypto journey safely.

Is Cryptocurrency Legal in India?

Before investing in crypto, you need to know whether it is legal in India. The simple answer is yes; How to Buy Cryptocurrency in India legally is possible, but there are a few conditions. The Reserve Bank of India (RBI) previously restricted banks from dealing with crypto companies. However, in March 2020, the Supreme Court of India lifted that ban.

Today, Indian exchanges like WazirX, CoinDCX, and ZebPay operate openly, and millions of Indians use them.

However, cryptocurrency is not considered legal tender. You cannot use Bitcoin to buy groceries or pay rent directly. Instead, it is viewed more as a digital asset, similar to gold or shares. From April 2022, the government introduced a 30% tax on profits from cryptocurrency trading and a 1% TDS (tax deducted at source) on certain transactions. So yes, How to Buy Cryptocurrency in India is a common question because crypto is legal to buy, sell, and trade in India, but you must follow the tax rules.

Steps to Buy Cryptocurrency in India

Buying cryptocurrency in India is quite simple. You don’t need to be a tech expert. All you need is a smartphone, internet access, and a verified account on a crypto exchange. If you are searching for How to Buy Cryptocurrency in India, here are the steps:

1. Choose a Trusted Crypto Exchange

The first step is to pick a safe and reliable exchange. Some of the most popular exchanges in India are:

- WazirX : One of India’s largest exchanges, with easy UPI deposits.

- CoinDCX: Known for its beginner-friendly features and strong security.

- ZebPay: One of the oldest crypto platforms in India.

- Binance: A global exchange with advanced trading features.

For beginners, WazirX and CoinDCX are usually the easiest to start with.

2. Create and Verify Your Account (KYC Process)

Once you choose an exchange, you need to sign up and complete KYC (Know Your Customer). This step is mandatory under Indian law. You’ll need to upload:

- Your PAN card

- Aadhaar card (or any government ID)

- A selfie for verification This process usually takes a few minutes to a few hours.

Once your KYC is approved, your account is ready.

3. Add Money to Your Account

After your account is verified, the next step is to add funds. Most Indian exchanges allow:

- UPI (Google Pay, PhonePe, Paytm, etc.)

- Bank Transfer (IMPS, NEFT, RTGS)

- Sometimes debit/credit card (with extra fees)

For beginners, UPI is the fastest and easiest method. You can start with as little as ₹100 to ₹500 depending on the exchange.

4. Buy Your First Cryptocurrency

Now comes the exciting part—buying your first crypto!

- Go to the exchange app or website.

- Search for the cryptocurrency you want, like Bitcoin (BTC), Ethereum (ETH), or others.

- Enter the amount you want to buy.

- Click Buy.

Within seconds, your purchased crypto will show up in your account balance.

5. Store Your Cryptocurrency Safely

After buying, your crypto will be stored in the exchange’s wallet. While this is fine for beginners, it is always safer to keep your coins in a personal wallet.

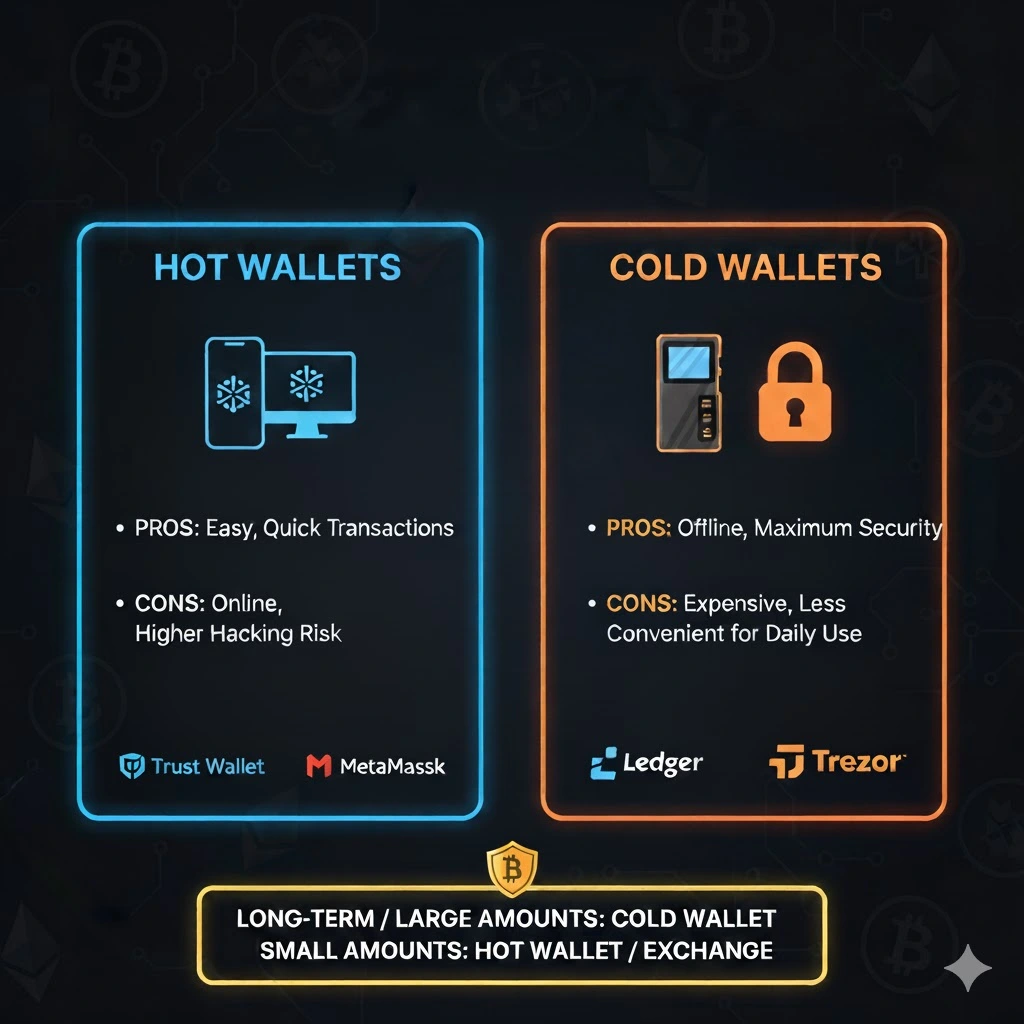

There are two types of wallets:

- Hot Wallets – Apps connected to the internet (easy but less secure). Examples include Trust Wallet and MetaMask.

- Cold Wallets – Offline hardware devices (most secure). Examples include Ledger and Trezor.

If you plan to hold crypto for a long time, a cold wallet is the safest option.

Best Cryptocurrency Exchanges in India

When buying cryptocurrency, the platform you choose is very important. A good exchange makes the process simple, fast, and safe. A bad exchange, on the other hand, can lead to delays, high fees, or security risks. If you are wondering How to Buy Cryptocurrency in India, here are some of the top exchanges in India that beginners usually prefer:

1. WazirX

Why it’s popular : WazirX is known as India’s biggest crypto exchange. It has millions of users and offers a very simple app for beginners.

- Payment options: UPI, IMPS, bank transfer.

- Pros : Easy to use, quick deposits, a large number of coins listed.

- Cons : Sometimes withdrawal charges can be a little high.

2. CoinDCX

Why it’s good for beginners: CoinDCX has a very clean and user-friendly app. Even if you’re new, you can buy Bitcoin or Ethereum in under a minute.

- Payment options : UPI, bank transfers, net banking.

- Pros : Very smooth user interface, trusted by millions, strong security.

- Cons : Doesn’t always list the very newest international coins.

3. ZebPay

Why people trust it: ZebPay is one of the oldest exchanges in India. Many early investors in India started with this app.

- Pros : Long track record, strong security, clean interface.

- Cons : A smaller number of coins compared to WazirX or Binance.

4. Binance

Why it stands out: Binance is the world’s largest global exchange. It offers hundreds of coins, advanced trading tools, and high liquidity.

- Pros : Very wide range of coins, professional tools, low fees.

- Cons : Can be confusing for beginners, and since it is global, INR deposits may require linking with WazirX.

For beginners in India, WazirX and CoinDCX are the best starting points, while Binance is better once you gain some experience.

Payment Methods for Buying Cryptocurrency in India

When you’re ready to buy, you’ll need to add funds to your exchange account. Luckily, most Indian exchanges support easy payment options.

- UPI (Unified Payments Interface) :This is the fastest and easiest way. If you are learning How to Buy Cryptocurrency in India, you can use apps like Google Pay, PhonePe, Paytm, or BHIM to transfer money directly to your exchange wallet. Most deposits are instant.

- Bank Transfers (IMPS/NEFT/RTGS) : If you’re investing larger amounts, a direct bank transfer is a good option. It may take a little longer than UPI but is reliable.

- Debit and Credit Cards : Some exchanges allow card payments. However, there may be extra charges (2–3%) for using cards.

- P2P (Peer-to-Peer) Trading : Some exchanges like Binance and WazirX also offer P2P trading, where you can buy crypto directly from another person by sending money to their bank account. If you are exploring How to Buy Cryptocurrency in India, this method is also popular. The exchange acts as an escrow, keeping your crypto safe until the payment is confirmed.

For beginners, UPI is the easiest and cheapest method.

How to Store Cryptocurrency Safely

Many beginners make the mistake of keeping all their crypto in the exchange. While exchanges are generally safe, they can still be hacked or face restrictions. If you are learning How to Buy Cryptocurrency in India, you should also know that serious investors use crypto wallets for better security.

1. Hot Wallets

These are online wallets (apps or browser extensions) connected to the internet.

- Examples : Trust Wallet, MetaMask

- Pros : Easy to use, quick transactions.

- Cons : More risk of hacking because they are online.

2. Cold Wallets

These are offline hardware wallets like USB devices. They store your crypto without an internet connection.

- Examples : Ledger Nano, Trezor

- Pros : Very secure, almost impossible to hack.

- Cons : Expensive (₹5,000 to ₹15,000) and not as convenient for daily trading. If you’re only buying small amounts, keeping crypto on the exchange or in a hot wallet is fine. But if you are serious about How to Buy Cryptocurrency in India safely and plan to hold for the long term or invest large amounts, consider getting a cold wallet.

Risks of Buying Cryptocurrency in India

Before diving into crypto, you should know the risks. Like any investment, cryptocurrency has both opportunities and dangers.

- Price Volatility :The biggest risk is price swings. For example, Bitcoin can rise 20% in a week but also fall 30% the next week. If you are learning How to Buy Cryptocurrency in India, you should understand that this volatility can be exciting but also stressful.

- Scams and Fraud : Crypto is still new, and many scams exist. Fake apps, Ponzi schemes, and “get rich quick” offers are common. If you are searching for How to Buy Cryptocurrency in India, always remember to use trusted exchanges and never share your private keys.

- Regulatory Uncertainty : While crypto is legal in India, the government is still figuring out regulations. New rules or higher taxes in the future could impact investors.

- Security Risks : If you don’t store your crypto safely, you could lose it forever. Unlike a bank account, there is no customer care number for Bitcoin.

Tax on Cryptocurrency in India

Since April 2022, the Indian government has made it clear that crypto profits will be taxed. Here’s how it works:

- A 30% flat tax on any profits you make from selling crypto.

- A 1% TDS (Tax Deducted at Source) on every trade above a certain limit.

- No deductions allowed (you can’t claim expenses like internet bills). This means if you buy Bitcoin at ₹1,00,000 and sell it at ₹1,50,000, your profit is ₹50,000. You’ll pay 30% tax (₹15,000) on that profit. So, while crypto is exciting, you must also plan for taxes.

Tips for Beginners

If you’re new to crypto, here are some simple but powerful tips:

- Start Small : Don’t invest all your savings. Begin with ₹500 to ₹1,000 to learn.

- Do Your Research (DYOR) : Always study a coin before buying. Don’t just follow the hype.

- Avoid Panic Buying/Selling : Prices move fast. Don’t act on emotions.

- Use Trusted Exchanges Only : Stick to WazirX, CoinDCX, Binance, ZebPay.

- Keep Your Crypto Safe : Learn about wallets and never share private keys.

Advanced Tips for Crypto Investors in India

Once you’ve learned the basics, you might want to go a step further. Here are some advanced tips that can help you become a smarter investor.

1. Diversify Your Portfolio

Don’t put all your money into just one coin like Bitcoin or Ethereum. While they are the safest bets, it’s always wise to spread your investments across a few coins. For example, if you are researching How to Buy Cryptocurrency in India, you can keep:

- 50% in Bitcoin (BTC) – the most stable coin

- 30% in Ethereum (ETH) – used in smart contracts and DeFi

- 20% in other altcoins (like Solana, Polygon, or Cardano)

- This way, even if one coin falls, others can balance your portfolio.

2. Learn About Dollar-Cost Averaging (DCA)

Instead of investing all your money at once, you can buy small amounts regularly. For example, you could invest ₹1,000 every week, no matter the price. If you are following How to Buy Cryptocurrency in India for beginners, this strategy, called Dollar-Cost Averaging, reduces the impact of market volatility.

3. Be Aware of FOMO (Fear of Missing Out)

When prices shoot up, many beginners jump in without research. However, these sudden spikes are often followed by crashes. If you are exploring How to Buy Cryptocurrency in India, always remind yourself, “If I missed this train, there will always be another.”

4. Follow Crypto News and Updates

Crypto prices are affected by global events, regulations, and technology updates. For example,

- A government ban can make prices drop.

- A major company adopting crypto can make prices rise. You can follow reliable sources like CoinDesk, CoinTelegraph, or even Indian news outlets that cover finance.

5. Never Invest More Than You Can Afford to Lose

This is the golden rule. Unlike fixed deposits or gold, crypto has no guaranteed returns. Only invest money that you can live without if things go wrong.

Future of Cryptocurrency in India

- Rising Popularity Among Youth : India has one of the largest numbers of young internet users in the world. Many of them are already exploring digital assets. This trend is anticipated to grow in the coming times, especially as more people search for How to Buy Cryptocurrency in India and begin investing in digital assets.

- Government Regulations : The government is working on a cryptocurrency bill. While details are not finalized, it is clear that crypto will not be banned. Instead, new rules will be introduced to ensure safety and prevent misuse, especially as public interest in How to Buy Cryptocurrency in India continues to grow.

- Growth of Blockchain Technology : Beyond trading coins, the technology behind crypto, blockchain, has great potential in India. It can be used in supply chain management, banking, healthcare, voting systems, and more.

- Digital Rupee by RBI : The Reserve Bank of India has started working on its Central Bank Digital Currency (CBDC), called the Digital Rupee. This shows that the government is serious about digital finance, further increasing interest in How to Buy Cryptocurrency in India among young investors.

All of this means crypto and blockchain are here to stay. Early investors in India may have a big advantage in the coming decade.

Common Mistakes to Avoid

While buying crypto in India is easy, many beginners make mistakes that cost them money. Here are some pitfalls to avoid:

- Investing Without Research – Don’t buy a coin just because it’s trending on Twitter. Always check its use case and team.

- Keeping All Money on Exchange – Exchanges can be hacked. Always move large funds to a wallet.

- Ignoring Taxes – Many people forget about taxes until it’s too late. Always keep records of your trades.

- Falling for Scams – Beware of fake websites, Telegram groups, and YouTube videos promising “guaranteed returns.” There is no guarantee in crypto.

- Overtrading – Checking prices every five minutes and buying or selling too often can lead to losses. Sometimes, holding patiently works best.

A Step-by-Step Example (For Clarity)

Let’s imagine you are a student in Delhi who wants to invest ₹1,000 in cryptocurrency. Here’s how your journey would look:

- You download the CoinDCX app from the Play Store.

- You sign up and upload your PAN card and Aadhaar card for KYC.

- Within an hour, your account gets verified.

- You add ₹1,000 using UPI via Google Pay.

- You decide to buy ₹500 worth of Bitcoin and ₹500 worth of Ethereum.

- The coins appear in your CoinDCX wallet instantly.

- You read about safety and decide to transfer them to Trust Wallet.

- After a few months, the value of your coins grows, and you book a profit.

- You pay 30% tax on your profit when filing your ITR.

This is how thousands of beginners in India are starting their crypto journey.

Conclusion

Cryptocurrency is one of the most exciting financial innovations of our time, and India is becoming a major part of this global trend. While the journey comes with risks, it also offers big opportunities for those who are careful, patient, and well-informed, especially those who are learning How to Buy Cryptocurrency in India the right way.

If you’re a beginner, the steps are simple:

- Choose a trusted exchange.

- Complete your KYC.

- Add funds via UPI or bank transfer.

- Buy your first coin.

- Store it safely in a wallet.

Remember, crypto is not about “getting rich overnight.” It’s about learning, experimenting, and slowly building your financial future. Just like researching Top Mobile Brands in India helps you make a smart smartphone purchase, learning How to Buy Cryptocurrency in India step by step helps you make informed financial decisions. If you invest wisely and avoid common mistakes, cryptocurrency can become a valuable addition to your investment portfolio.

Digital marketing agencies like Shark Mondo also educate people about online trends and financial awareness, helping them grow in today’s digital world. So, if you’ve been curious about How to Buy Cryptocurrency in India, now is the time to start small, learn, and grow. The earlier you begin, the more experience you’ll gain as this digital revolution unfolds.